Young Money

Description of Young Money

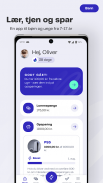

Young Money is a digital money and savings universe for children and young people aged 7-17... and their parents!

With the app, children, young people and their parents get the opportunity to easily follow income, savings targets and consumption in an easy and safe way. Language and functions in the app are automatically adapted to the user's age, and will therefore vary depending on whether you are, for example, 7, 13 or 17 years old.

Both parents and child must be customers of one of the banks that offer Young Money.

As a 7-17 year old you can:

- Always see how much money you have and follow your consumption

- Ask his parent for money

- Transfer money to parent

- See the amount that can be earned by solving regular and one-off tasks from the parent

- Keep track of what you owe others and what others owe you

- Continuously see messages with insights based on one's actions

- See how much money has gone in and out, and thus understand the money left in the account

- Create, adjust and prioritize your savings goals

- Calculate when it is realistic to reach your savings target

- Choose an avatar or upload your own photos on your profile

- Receive monetary gifts from his parent

- See if your parent has set up an extra incentive for completing savings targets

- Achieve a high streak score when you keep track of your finances

As a parent, you can:

- Follow your child's consumption and savings goals

- Transfer money to your child

- Create regular and one-off tasks for your child

- Give your child's savings goal a boost, so that you strengthen the incentive to pursue goals and use the money properly

- Send monetary gifts to your child (including the option of a physical monetary gift)

- Receive money from your child

- Receive ongoing info messages with insights and required actions

Download the Young Money app today and start the good dialogues about healthy money habits at home and get a good foundation for a good understanding of money.

You can order and read more about Young Money at www.youngmoney.dk.